mississippi property tax calculator

872 public schools in 140 school districts educating 470668 students source. The median property tax in Mississippi is 50800 per year052 of a propertys assesed fair market value as property tax per year.

Property Tax Calculator Estimator For Real Estate And Homes

Lee County collects on average 074 of a propertys assessed.

. Your average tax rate is 1198 and your. Mississippi Income Tax Calculator 2021. Motor Vehicle Ad Valorem Taxes.

Property Tax main page forms schedules millage rates county officials etc Ad Valorem Tax Miss. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Mississippi property tax records tool to get. DeSoto County collects on average 07 of a propertys.

Its income tax system has a top rate of just 500. This is only an estimate based on the current tax rate and the approximate value of the. In Mississippi property tax revenues are used to fund the following.

The tax assessor has a Tax Calculator to help you estimate the cost of your property taxes. The median property tax in Lee County Mississippi is 788 per year for a home worth the median value of 107100. The median property tax in DeSoto County Mississippi is 1067 per year for a home worth the median value of 152300.

Mississippi has one of the lowest median property. Income taxes are also progressive which means. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

John is filing as a single taxpayer in Mississippi. Overview of Mississippi Taxes. For comparison the median home value in Marshall.

Mississippi tax year starts from july 01 the year before to june 30 the current year. Mississippi property tax laws have special rules for senior citizens who are older than 65 and people who are disabled regardless of age. Section 27-31-1 to 27-53-33 All property real and personal is appraised at.

Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. For comparison the median home value in Harrison.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Overall Mississippi has a relatively low tax burden. You are able to use our mississippi state tax calculator to calculate your total tax costs in.

His annual taxable income is 23000. Lets take a look at an example provided by the Mississippi Department of Revenue. This calculator is excellent for making general property tax comparisons between different states and counties but you may want to use our Mississippi property tax records tool to get.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Mississippi Department of Education. Instead of the 300 credit the first.

All sales of tangible personal property in the State of Mississippi are subject to the regular retail rate of sales tax 7 unless the law exempts the item or provides a reduced rate. For comparison the median home value in Mississippi.

How To Calculate Property Tax 10 Steps With Pictures Wikihow

Lottery Calculator The Turbotax Blog

Car Tax By State Usa Manual Car Sales Tax Calculator

Property Tax Calculator Property Tax Guide Rethority

Dmv Fees By State Usa Manual Car Registration Calculator

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Las Vegas Sales Tax Rate And Calculator 2021 Wise

Tax Calculator Chanute Ks Official Website

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Sales Tax On Cars And Vehicles In Mississippi

1031 Exchange Mississippi Capital Gains Tax Rate 2022

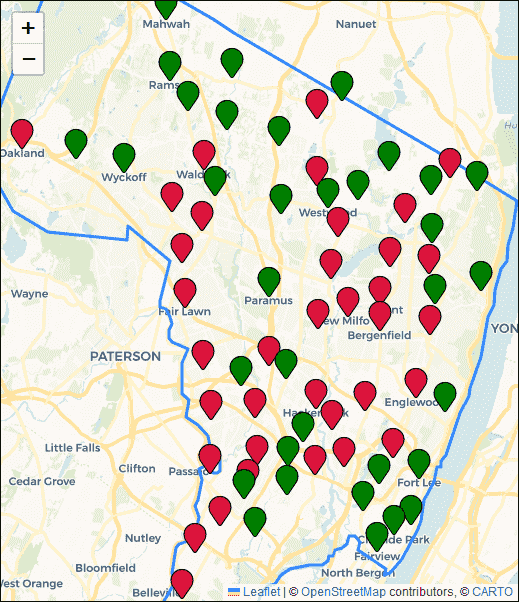

Bergen County Nj Property Property Tax Rates Average Tax Bills And Home Assessments

Usa Property Taxes For Foreign Nationals State Wise Guide

Mississippi Property Tax Calculator Smartasset

Mississippi State Taxes 2021 Income And Sales Tax Rates Bankrate

Mississippi State Income Tax Ms Tax Calculator Community Tax

Mississippi State Income Tax Ms Tax Calculator Community Tax

2022 Massachusetts Property Tax Rates Ma Town Property Taxes