does shopify provide tax documents

The Alabama Department of Revenue requires certain non-collecting sellers to notify customers about their potential use tax liability provide customers with an annual purchase summary and provide the state with a customer information report. Since its paid by the consumer not the seller its one tax your business doesnt have to worry about.

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar

Of course sending an invoice email isnt always the end of the story.

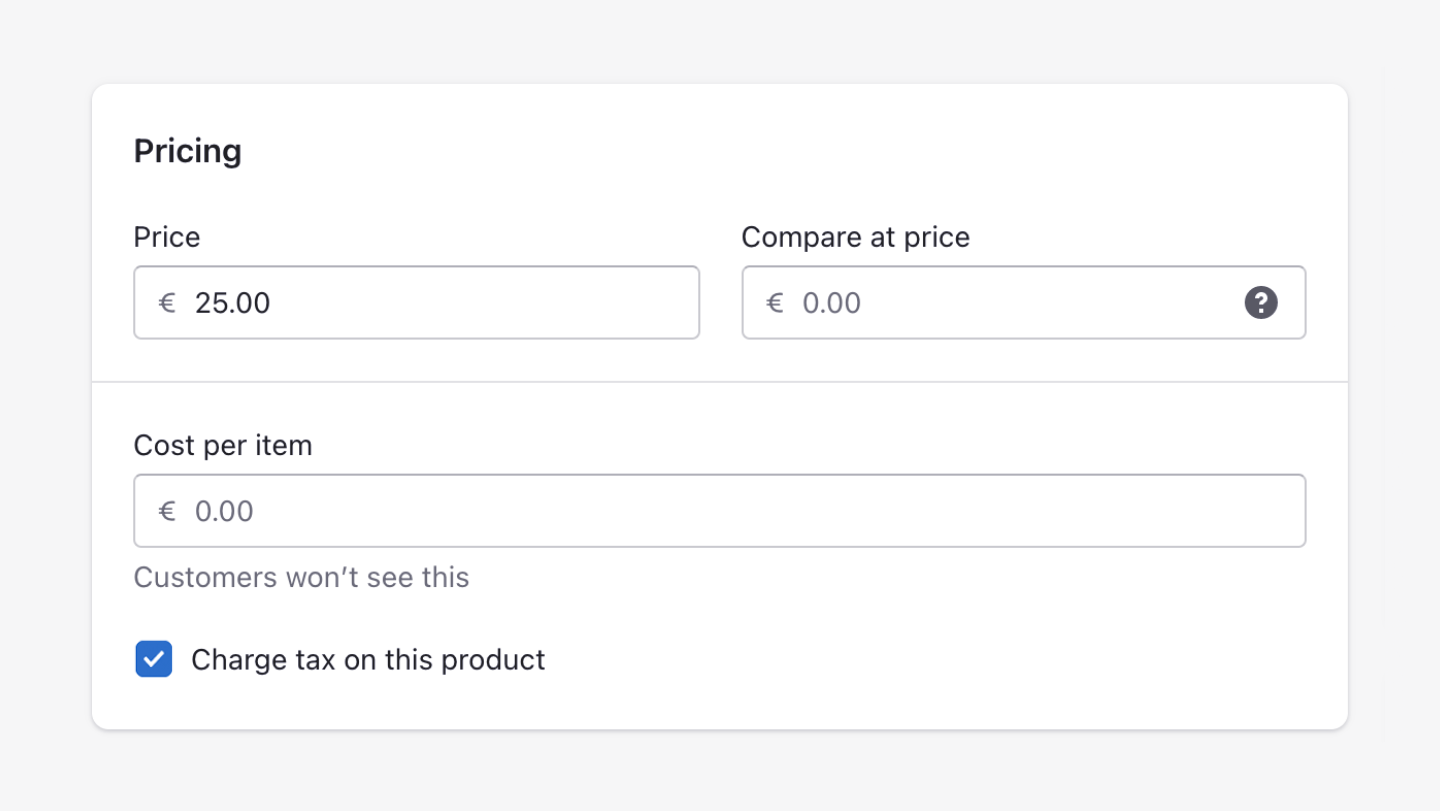

. Tax rules and VAT MOSS in Shopify Automatic tax calculations. See answers to frequently asked questions below and learn more at the IRS website. Trailing nexus Sales tax nexus can.

Depending on local municipalities the total tax rate can be as high as 90625. Virtually everyone in the industry is cautioning taxpayers to. Connect with a US-based lawyer or purchase asset-specific template legal documents via Flippa Legal.

The foundation of solid business bookkeeping is effective and accurate expense tracking. Sometimes your clients may delay payment. We provide a deep analysis identify hidden risks and independently assess the value of the business.

Track your expenses. As you can see the best invoice emails are simple friendly and provide all the information the client needs to process your invoice. The New Mexico NM state sales tax rate is currently 5125.

Information in this document does not constitute tax legal or other professional advice. Check with the individual bank for which documents to bring to the appointment. Name and postal address of the Registered Name Holder.

A purchase order or PO is an official document issued by a buyer committing to pay the seller for the sale of specific products or services to be delivered in the future. Registrant must provide the following information as part of the domain name registration process and promptly correct and update during the term of the registration. Further upgrades for Advanced Shopify or Shopify Plus can provide deep analysis with the help of filters apart from the basic analysis from Basic Shopify.

Thankfully Shopify allows you to apply tax rates automatically for several territories which if youre lucky. For more information about the precise nature of these requirements see Alabama Senate Bill 86. Generally a business will pass that tax on to the consumer so that it resembles a sales tax.

You can conduct this yourself or use our new official due diligence service. AARP Offers Free Assistance What Documents Will You Need To Provide. One of the challenges of selling online is that you can end up making sales in a variety of jurisdictions with different tax rates something you have to reflect in the pricing of your products.

Its a crucial step that lets you monitor the growth of your business build financial statements keep track of deductible expenses prepare tax returns and legitimize. Following up on your invoice email. If you are unable to provide the same then the department will reject your claim and ask you to pay additional tax on the income along with interest and penalty.

Overall Shopifys analytics and reports give merchants the means to review a stores recent activity get insight into their visitors analyze store speed or even analyze stores transactions. For instance if you buy a car in sales tax-free New Hampshire but live in Massachusetts you still have to pay a tax on it in your home state when. Penalties if discovered by tax department Chandak says When an.

This is a tax that consumers pay for use of an item in their state that they bought in a different state. The tax department will ask you to provide documents and transactional proofs such as bank account statement etc. Name postal address e-mail address and.

Names of the primary nameserver and secondary nameservers for the Registered Name. Its been widely published that the IRS long underfunded and understaffed is buckling under the pressure of last years backlogs and this years tax season at the same time. Frequently Asked Questions Regulations.

Packages start at 1000. In these cases its always a good idea to get in touch with your contact by phone as its possible. New Mexico has a gross receipts tax that is imposed on persons engaged in business in New Mexico.

If you have questions or require guidance on these matters please contact your tax legal or other professional adviser.

Finding And Filing Your Shopify 1099 K Made Easy

Sales Tax Liability 5 Things To Know For Your Shopify Store Taxjar

Shopify Sales Tax Setup Where And How To Collect Ledgergurus

Will I Be Getting A 1099 K Form If So When Shopify Community

Shopify Sales Tax Setup Where And How To Collect Ledgergurus

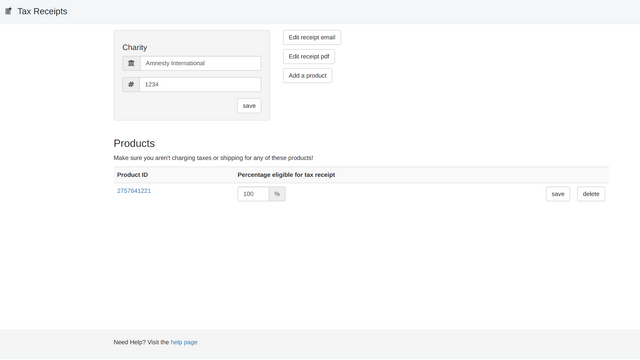

Tax Receipts Customizable Donation Receipts For Your Customers Shopify App Store

Why Are Taxes Missing On My Shopify Orders And Invoices Sufio For Shopify

Add A Bank Account To Pay For Your Invoices On Shopify Avada Commerce Accounting Information Google Tag Manager Shopify

Shopify Colorado Sales Tax Ecommerce Bookkeeping Services Business Structure